The length of time over which your mortgage is financed. This may be anywhere up to 40 years, with 25 years being the traditional amortization. Note that amortization is different than “term” which is the length of your agreement with the lender.

Appraisal

The process of determining the value of property, usually for lending purposes. This value may or may not be the same as the purchase price of the home. A qualified appraiser physically inspects the property making note of condition, special features and then assesses the value including assessment of comparable properties.

Assumable

This means that your mortgage MAY be taken over by another party if, for example, you sold your house and the buyer wanted to take over your mortgage payments. This may be of an advantage to a buyer if the rate on your mortgage is lower than current rates. Even though the mortgage is assumable, the borrower MUST qualify to the satisfaction of the lender.

Bank Statements

Part of the approval process for a mortgage involves the lender confirming your down payment money, to both ensure you have enough and to meet government requirements for confirming the sources of funds used towards real estate purchases. Typically, the lender will require your bank statements showing the most recent 90 days of banking transactions for each of you bank accounts that hold funds which will be used towards the purchase.

If possible, it’s best to provide official monthly statements received in the mail or official monthly PDF statements that you download from online banking. These documents are guaranteed to show your full name and the account details correctly. Depending on your bank, we may also be able to accept an online banking transaction history printout, but only if the printout shows the bank account number and we can match that to your name with another document (like an old paper statement or a VOID cheque).

If you have transferred money between multiple accounts within the 90 day time period, as we will need the 90 days of transaction history for each bank account to show the money moving between them. This allows us to match up the deposits and withdrawals and confirm for the lender that the funds have been in your possession for the whole period, and that no money has come from illegitimate sources.

As well, if your bank statements show any large deposits (over $1,000) where the source isn’t obvious from the transaction description (direct payroll deposits, tax refunds, etc are fine because they will have a clear description), the lender may request more information about the source of those funds in order to satisfy Federal Government regulations. Once your broker reviews the bank statements they will confirm if any additional information is needed.

For detailed instructions on how to download your bank statements or generate transaction histories from your online banking, see our custom guides below for each major bank:

- RBC

- TD Canada Trust

- Scotiabank

- CIBC

- Bank of Montreal

- Tangerine

- Simplii

- Coast Capital Savings

- First Credit Union

- Wealth Simple

Blend and Extend

Taking your existing mortgage and adding to the term and combining the old and new rate into a blended rate on a weighted basis. It can be a good way of avoiding prepayment penalties if you are moving and increasing the size of your mortgage.

Blended Payment

Usually refers to a payment that includes principal and interest.

Borrowell

Borrowell is a free credit monitoring service that won’t have a negative impact on your credit score when you use it to check your credit. They are a ‘recommendation’ business, so they do make money by referring you to certain credit card and loan offers – however you do not have to take any of the offers or recommendations to use the credit monitoring service.

In order to download your Equifax Credit Report for free from Borrowell, create your account at www.borrowell.com and log in.

In the menu across the top, click the “Credit Report” link and then click the “Download Your Credit Report” link to the top right side of that page:

Canada Child Benefit (CCB)

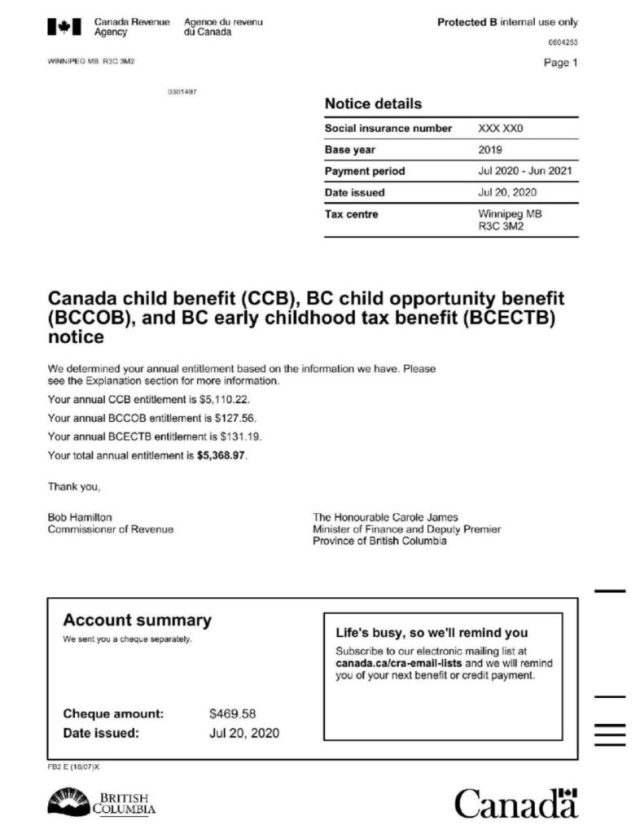

The Canada child benefit (CCB) is a tax-free monthly payment made to eligible families to help with the cost of raising children under 18 years of age. It is administered by the Canada Revenue Agency and you will receive an annual statement each year (typically in summer) showing the payments you will receive for the upcoming 12 month period. Here is a sample of the CCB annual Statement for reference:

CCB annual notice – sample doc

For specific details on the program, including a benefit calculator, see the government website:

For mortgage purposes, there are several lenders that will consider CCB income for use towards mortgage qualification. The lender will need to confirm your CCB income amount (by way of your most recent annual statement from Canada Revenue) and will also typically ask for confirmation of the ages of your children to confirm that you will continue receiving the CCB income for the duration of your mortgage term. For example, if you are taking a 5 year mortgage term, the lender will need to confirm your children are all ages 12 and under so that none will cross over the age 18 threshold of the CCB program during the mortgage term.

Closing Costs

See the full page on Closing Costs.

CMHC

Canada Mortgage and Housing Corporation (CMHC) operates a Mortgage Insurance Fund which protects approved lenders from losses resulting from borrower default. CMHC insurance can insure for loans where the mortgage amount is greater than 80% of the value of the property, and insures for a variety of other specialty lending situations. A premium is charged for the insurance. www.cmhc.ca